Success in the new year means embracing change and being flexible

Whew. It’s been quite a year.

Records broken for low inventory, and high margins. Low sales volumes, and high profits. There are ongoing political conflicts, supply and labour shortages, unpopular new taxes and bumps in the electrification road to 2035. But compared to the last few years, this year was a promising return to what we might consider “normal.”

But how far back to normal do we want to go?

Certain conditions, like low inventories, led to dealers not having to pay for hundreds of cars on their lots, and led to OEMs not having to discount vehicles

to make way for new models.

Will they want to go back to the old days? Certainly there is pent-up demand still out there, which may be tempered

by rising interest rates, or it may not.

Canadian auto dealer reached out to people from many different sectors of the industry to see what they think is the “new normal”, and we asked them to look into their crystal balls to envision what 2023 may hold in store for auto dealers.

OEMs have been putting their limited supply of components like semiconductors into their vehicles with highest margins, so the affordability of EVs to the average consumer is still way too high.

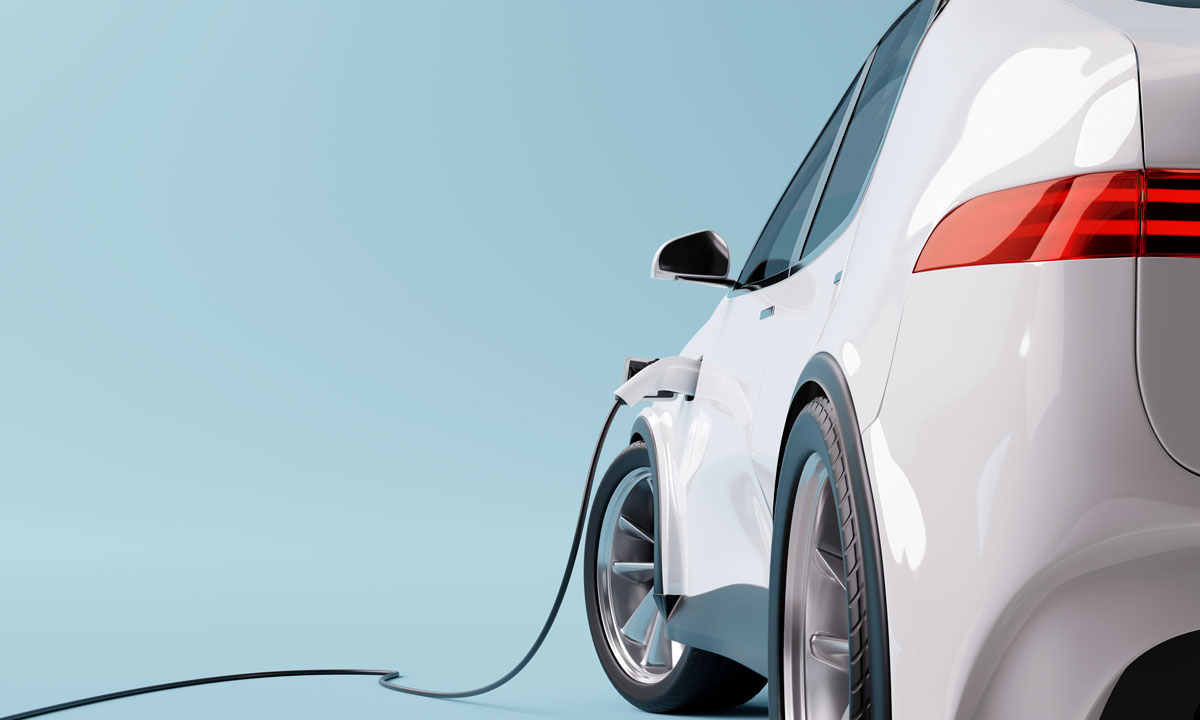

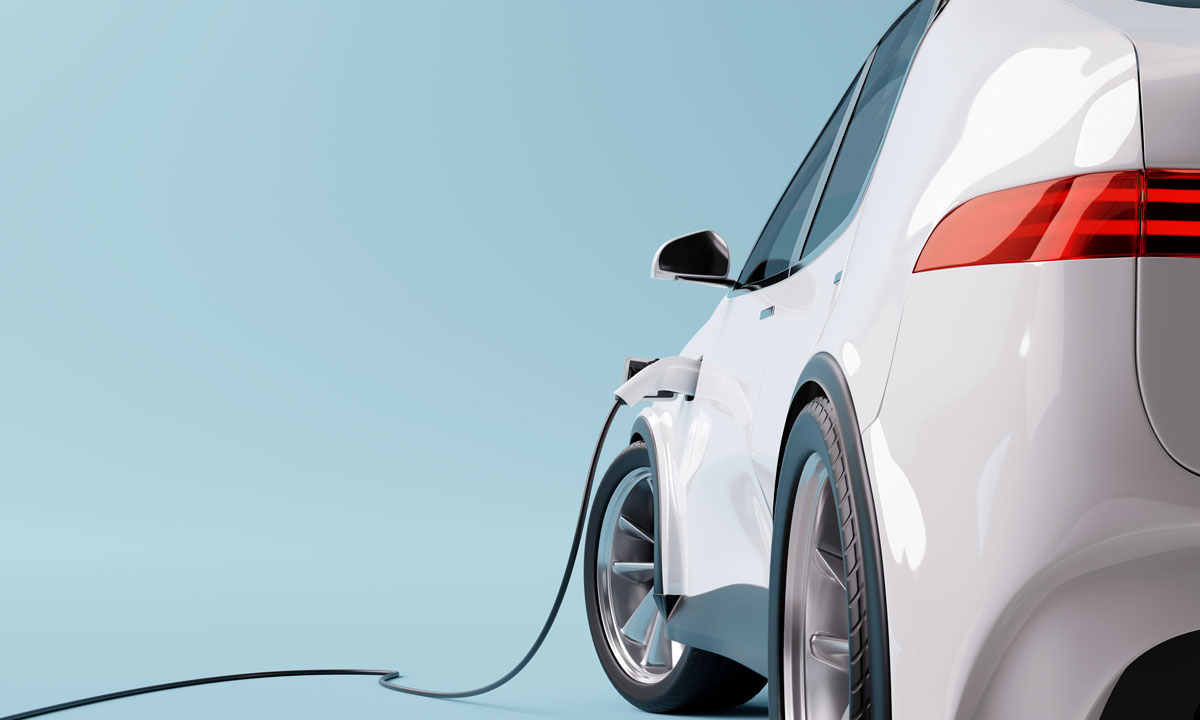

For an overview of the entire industry, we asked Darren Slind, Co-Founder and Managing Director of Clarify Group, a research and consultancy firm, and formerly of J.D. Power, what he sees as being important trends and conditions going into this new year. Slind sees an industry focused on electrification. “There are trends that are accelerating, as opposed to things that are new,” he said. “EV market penetration is a continued topic of great interest across the entire industry, whether you’re an OEM, a dealer, or a supplier. And of course we continue to see uneven EV penetration across the country. BC and Quebec punch way above their weight class in terms of the proportion of sales that they deliver that are EVs relative to their total mix of business.”

So this points to the rest of the country needing to become more open to EVs, and this is going to take some major cultural and infrastructure shifts, says Slind. “There’s an interesting correlation, if you look at the electrical grids in BC and Quebec, they are almost 100 per cent sustainably generated energy,” he said. “The fact that these grids are so clean and efficient is a source of great pride. To extend that into EV ownership makes perfect sense.”

Despite generating the vast majority of its energy from renewable sources, Ontario consumers have not caught on to EVs like those in BC and Quebec, and that needs to change, as Ontarians have by far the largest overall sales volume in the country. “I call it The Ontario problem,” said Slind. “I don’t think the federal government can achieve the goal of 2035, which is a hundred percent electrified sales, without Ontario getting its proverbial act together.”

The second influential condition Slind sees going forward is the lack of EV inventory. Consumers can order a new car, but they’ll have to wait 18-24 months to get it. “Not a lot of consumers are willing to do that,” he said,

“Some might be, especially if it’s a second vehicle. But if it’s your primary car and your lease is up or up soon, you just cannot wait. So there is obviously a production supply gap in terms of continuing the pace of EV adoption.”

OEMs have been putting their limited supply of components like semiconductors in their vehicles with highest margins, so the affordability of EVs for the average consumer is still way too high. “I think it’s worth mentioning that we desperately need to see more activity from the manufacturers in lower segments of the market, that Canadians can actually afford.”

As vehicles get more expensive, consumers are opting for longer and longer loan terms to afford the one they want, which may be good news to lenders, but it’s bad for dealers, says Slind. “Long term, I don’t see that as good for the dealer because it pulls that customer out of the market for a very long time. And I think consumer sentiment is such that when you’re in the sixth, seventh or eighth year of a contract, and your needs have changed and you’re driving a no-longer-new vehicle which is out of warranty, you may start resenting the brand, and the dealer as well.”

As OEMs make it more expensive to run a car business, more and more dealers are selling to big dealership groups, and Slind sees this as a trend which is going to continue, accelerated by the imminent electrification of the industry. “The cost of doing business these days in an industry that is under such dramatic transformation on so many fronts, and the investment that is needed to operate successfully in today’s market, is going up,” he said.

“Even just building EV infrastructure at a dealership, whether it’s the installation of fast chargers, special diagnostic equipment, or a special hoist because EVs are considerably heavier. So you have to service them differently. There’s investment needed to to build out the infrastructure to be a successful retailer in the EV space.”

From the OEM perspective, David Adams, President of the Global Automakers of Canada, thinks that while inventories will continue to be a challenge, profitability is still very attainable. “I think supply chain disruptions are going to continue to impact the market, and having vehicles on the lot will continue to be a challenge,” he told Canadian auto dealer. “As we have seen, this has some downside to it, as dealers won’t be able to sell the volumes that they’re used to selling. The upside is that they’re probably making better margins on the vehicles that they are selling.”

Adams sees demand being negatively affected by rising interest rates, to a degree that may require some incentivization on the part of manufacturers next year. “The challenge for consumers in the marketplace may require some intervention from the manufacturers to offset that to a certain degree,” he said. He predicts that while the job market is still stable, people will still want to buy new vehicles, but as time goes on, consumer confidence will trail off, which may be an issue for dealers. “When consumer confidence really starts to tail off, it’ll be a challenging environment.”

Toyota Canada’s district manager for Quebec and Atlantic Canada, Patrick Ryan, also spoke to Canadian auto dealer about where he thinks many OEMs are at, and what they are planning for in the new year. ”In terms of Toyota, the production is at full capacity right now with the parts that we have, though there is some parts shortage.” Ryan feels somewhat confident that production will ramp back up. “We’re offering vehicles in each of those segments, which is appreciated by consumers and dealers. I think we’ll slowly recover from this current situation, probably in the back half of 2023. That’s our anticipation.”

Ryan also spoke about how, while some OEMs are testing the waters for a direct-to-consumer retail model, Toyota is dedicated to their dealers.

EV market penetration is a continued topic of great interest across the entire industry, whether you’re an OEM, a dealer, or a supplier. And of course we continue to see uneven EV penetration across the country.

“We’re very proud to have the network that we have. It’s all about the dealer franchise model. The present and future will include our strong dealer network.”

Baker Tilly accountant Peter Heasty is a former Dealer Principal, who specializes in working in the dealership mergers and acquisitions space. He has been exceptionally busy over the last year, both with larger groups buying single stores or smaller groups, as well as with smaller transactions between single dealer owners.

He thinks the frenetic pace of the M&A sector will continue into the foreseeable future, for the reasons mentioned by Slind, as well as others. “Here are the fundamentals, he said. “One, there’s so much money out there from some of the larger groups and medium sized groups doing financially well, and they need a place to park that money.”

“There’s only so many new car dealers, and every year that goes by, the nice, juicy one-, two-, three- and four-store, little family businesses are being bought up. So if you’re a buyer, you’d better not be shy.”

— Peter Heasty, Accountant, Baker Tilly, and former Dealer Principal

This forecasted economic downturn may not be as good a buying opportunity as they may like though, according to Heasty. “Some of them might be thinking maybe this is an opportunity to grab some stores for less than they’ve been selling for in the last couple years. I think those thoughts are a mistake, because there are a lot of buyers, and a lot of money, and not enough sellers. It’s just simple math.”

These fundamentals are not likely to change in the next couple of years, though Heasty does agree with Slind that the general trend is toward consolidation. “There’s only so many new car dealers, and every year that goes by, the nice, juicy one-, two-, three- and four-store, little family businesses are being bought up. So if you’re a buyer, you’d better not be shy.”

So what about new technology that can help dealers be more efficient, secure and responsive to customers? We talked with Keith Murray from the quickly growing software company AutoVerify about what he thinks the new normal will be.

“This is not necessarily anything new, but we are hearing from dealers that they want to operate more efficiently. We are also seeing a continued focus on loyalty and customer relations management. Studies show consumers want to do more of the transaction online. Not necessarily buy a car online, but they want to do more of it online. What really excites us is our ability to now facilitate that kind of omni-channel transaction for the dealer.”

Chris Schaufele is national dealership service leader and a Business Advisor with MNP’s Assurance and Accounting group, one of Canada’s largest providers of accounting and professional services, and he thinks that in this unstable market dealers need to be able to react quickly to changing conditions. “It’s just being prepared for a shifting landscape, and being ready to address change as it happens. What we’re seeing is that dealers’ top line revenues have declined since before the pandemic, but their profits have obviously increased because they’re able to realize higher gross on a per unit basis with the conditions they’re operating in.”

Which seems like a pretty happy place to be. “Dealers are not going to be keen on shifting back to old ways of doing things. The OEMs probably will be,” said Schaufele.

“I think it’s important for dealers to have good communication with their OEM, and also their dealer council, to understand what’s going on, on the supply side, because the interest rate hike won’t only have an effect on consumer demand. It will also affect their loans and investments.”

So what do dealers think? “I think retail automotive will get back to a more traditional form of having to market and sell, rather than being able to have a position where you’ve got very few units on the lot, and you can say ’if you don’t take it at this price, sir, then someone else will’,” said John Sutherland, President of the Nova Scotia Automobile Dealers Association (NSADA). “That form of selling, I think, is going to go by the wayside.” Sutherland believes that as inventories return to normal, so will the sales practices. “I think for our dealers, they’re going to return to a somewhat similar and more conventional form of marketing that they’ve done very effectively for many years.”

Charles Bernard is the Lead Economist at the Canadian Automobile Dealers Association (CADA) which has been very busy over 2022 lobbying the government on behalf of Canadian auto dealers, as well as educating members on many different conditions currently affecting the retail auto industry.

Bernard feels that interest rates will help balance out the supply and demand inequity, but still thinks the ride ahead may see some bumps. “The year will be stressful, because interest rates are going up. It’s a business where margins are low and the market will change because of those new interest rates,” said Bernard.

“I think it’s important for dealers to have good communication with their OEM, and also their dealer council, to understand what’s going on, on the supply side, because the interest rate hike won’t only have an effect on consumer demand. It will also affect their loans and investments. But overall, I think having a good look on the supply side will be a good indicator of where the market is going for the next year.”

“This industry is resilient,” said Schaufele. “Dealers figure out what they need to do to be successful. You look at past downturns, like 2008, things declined in the industry, but it certainly wasn’t a long term trend. Dealerships continued to do well in spite of economic times.”