A powerful new tool, State of Charge Canadian EV Monitor, launches to measure EV consumer behaviour

The pace of automotive innovation continues to accelerate. Almost every OEM has made a company-changing announcement regarding their transition to electrification and the multiple billions of dollars in capital committed to achieve it. 2022 marks the beginning of an electrified vehicle onslaught in Canada across PHEV, BEV and Hybrid categories.

What makes this cadence significant is that we are about to see electrified vehicles in the segments Canadians care most about––utilities and pick-ups. Among the most eagerly awaited launches are the Kia EV6 (coming on the heels of its corporate sibling the Hyundai Ioniq 5), Genesis GV60, Nissan Ariya, Mitsubishi Outlander PHEV, and the Ford F-150 Lightning.

The EV-only disruptors are also pushing aggressively––the Lucid Air is now available in Canada, with VinFast and Rivian vehicles not far behind.

All indications point to the federal government moving to convert the 2035 goal of 100 percent zero-emission sales from “we should” to “we will” along with the legislative teeth to ensure it. All the focus is on EV supply. Build it and they will come.

As I learned all those years ago in Intro to Economics, however, market efficiency is only achieved when demand and supply are in balance.

Are we paying enough attention to the demand side of the equation? Where do Canadians really stand on EV adoption? Are they ready and willing to commit to electrified vehicles on the 2035 timeline? The planet may be screaming “yes,” but are Canadians?

The good news is that industry leaders––across OEMs, Suppliers, AutoFi, Dealers, Charging Providers and Policymakers––now have a new tool at their disposal to understand the demand-side of the equation: where do Canadians sit on the question of EV adoption and how is awareness, understanding and, most critically, intention shifting over time?

All indications point to the federal government moving to convert the 2035 goal of 100 percent zero-emission sales from “we should” to “we will” along with the legislative teeth to ensure it.

I consider it a professional privilege to author this column, and so avoid using this space for commercial purposes. I find myself, however, in the role of “proud parent” based on the work Clarify has been doing to bring an entirely new perspective to the disruptive challenges and opportunities we face. Thank you in advance for this small indulgence.

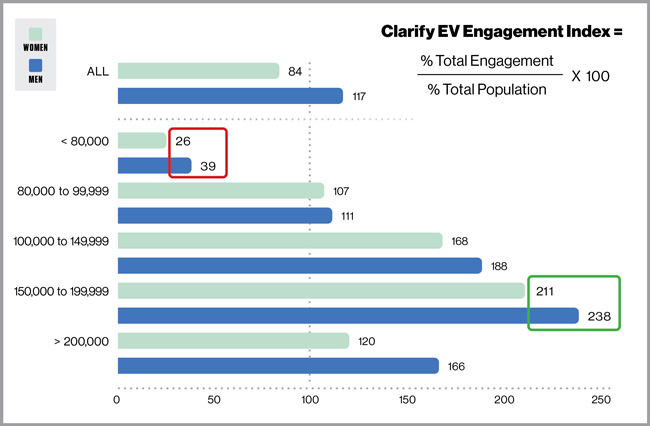

Source: Clarify State of Charge powered by Polly, representing the engagement of Canadians (representative sample of the general population consisting of over 191,000 adults (18+) from Nov 2018 to Nov 2021. Engagement = estimated number of Canadians discussing the broad topic of “electric vehicles” (excluding specific brands and models) during this time period.

Specifically, Clarify Group is excited to share with you some early insights from the State of Charge Canadian EV Monitor, an industry-wide study of EV consumer behaviour. State of Charge tracks the awareness, attitudes, behaviours, preferences and barriers to EV adoption on a scale and with a speed, frequency, and cost effectiveness that traditional research techniques simply can’t match.

Through use of sophisticated AI and augmented research techniques, State of Charge delivers the predictive insights that automotive decision-makers need to navigate their path forward.

Whereas traditional survey research works well when trying to understand where an industry or brand has been, augmented research delivers superior predictive insights by avoiding the significant disconnects between what consumers say they will do, compared to what they actually do.

Think of the 2016 U.S. presidential election. How many polls predicted a Democratic White House? Most of them. Why? Because respondents said one thing in the survey and did something completely different in the privacy of the voting booth. It’s clear at least some Canadians are doing the same thing when it comes to their EV intentions.

New tools for new challenges

One of the most interesting (early) insights we’re seeing in State of Charge relates to the engagement of Canadians on the broad topic of electric vehicles. For this particular analysis, we excluded discussions related to specific EV brands and models, preferring to first understand the broad level of awareness and engagement of Canadians. To put this analysis in context, we tracked the digital engagement of more than 190,000 Canadian adults over a three year period (Nov 2018 to Nov 2021).

Some things we expected, but a few things surprised us. A few examples:

Not So Surprising Findings:

- When compared to the volume of engagement across all automotive related topics, EV engagement is only at one-third the level. Clearly we are still in the early innings of the EV adoption game. Current levels of engagement are not sufficient to drive to the 2035 target. State of Charge will track this KPI carefully over time because engagement is a necessary first step to intention and ultimately adoption.

- EV engagement is highest in Quebec and BC, the two provinces most aggressive in EV adoption policies and incentives. Both provinces score above average in the Clarify EV Engagement Index at 114 and 113 respectively. The EV Engagement Index is calculated by comparing the proportion of total engagement to the relative size of the population. In this example, there is proportionately more EV engagement in these two provinces than we would expect given their relative size within Canada. By comparison, EV engagement in Saskatchewan (96), Ontario (92) and Manitoba (72) lag, at least in part due to provincial government resistance to EV purchase subsidies.

Surprising Findings:

- While EV engagement is correlated to household income, it is not perfectly so. Conventional wisdom holds that EV engagement is highest in the most affluent Canadian families. In fact, the EV engagement “sweet spot” is actually among households with annual incomes between $150,000 and $199,999. While the wealthiest households ($200,000 and higher) do “over-index” on EV engagement, it is at roughly two-thirds the level. EV engagement falls dramatically in households with incomes below $80,000. Given these households represent nearly 50% of all Canadians, it is clear a combination of generous government incentives (for new and pre-owned EVs) and the introduction of lower priced EV models will be needed to move the sales needle. It is hard to seriously consider an EV when the price points of most vehicles available exceed annual income.

EV engagement is highest in Quebec and BC, the two provinces most aggressive in EV adoption policies and incentives.

You’ll see and hear a lot more about the State of Charge Canadian EV Monitor in the months ahead. We anticipate it will become an indispensable tool for decision-makers across the industry to better understand demand dynamics. We’ll finally have predictive—not historical—research insights with which to maximize the strategic bets of stakeholders across the industry.

The transition to EV? Bring it on.