New streams of revenue are out there for those who are willing to adapt

The future is green, or at least moving closer to zero emission in the coming decades. The recent new vehicle registration market share figures from S&P Global Mobility for Q3 2022, showed zero-emission vehicles (ZEVs) represented 9.5 per cent of sales in Canada, up 70 per cent compared to the same period last year (5.6 per cent ZEV share in Q3 2021). ZEVs include battery electric, plug-in hybrid, and fuel cell electric vehicles—the common characteristic being they all have the capability to operate on electrons alone.

Indeed, in the major urban areas, ZEV sales accounted for a notable chunk of the market in Q3, with a 24 per cent share in Vancouver, 16 per cent share in Montreal, and even in the “no rebates for rich people” market of Toronto, one in 10 vehicles sold in the third quarter. All up from the same period in 2021.

Growing consumer interest in ZEVs and increased awareness of environmental issues, alongside an expanding range of attractive ZEV models on offer in Canada, have helped promote sales. Without supply constraints, ZEV share would be even higher—waiting lists for most ZEV models are now measured in months.

Good news for the sales department, but how encouraging is all of this for fixed operations?

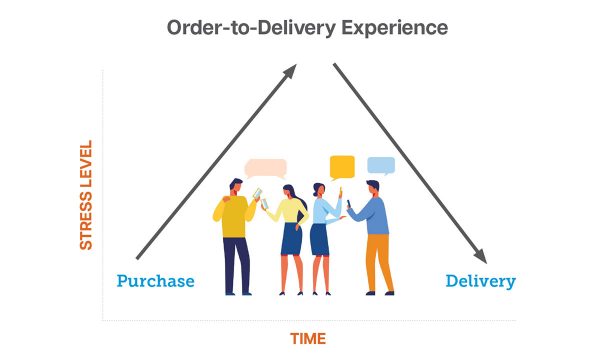

This thinking is consistent with Clarify’s TEFF retail success model: Transparent, Efficient, Flexible and Facilitated—in particular the opportunity of providing customers with a more facilitated (“easy”) transition from ICE to EV ownership.

A recent study commissioned by CLEPA, the European Association of Automotive Suppliers, in partnership with Roland Berger, stated that “BEVs have around 30 percent lower aftermarket replacement part revenue potential than ICE vehicles”. Overall service and parts revenues will decline over time for workshops unless they adapt to changing market conditions.

The number of gasoline vehicles dwarfs the number of ZEVs on the roads today, and service revenues will remain strong for these models, however, not indefinitely. There is both need and opportunity for dealerships to look at the transition to electric and changing mobility needs of consumers as a real opportunity to grow revenues outside the standard business model.

These opportunities are varied and require bold thinking. Indeed, change doesn’t come as easy to an industry used to managing its business successfully the same way for decades. In our view, however, the skills already contained within most Canadian dealership service operations can be adapted to capitalize on these new revenue streams.

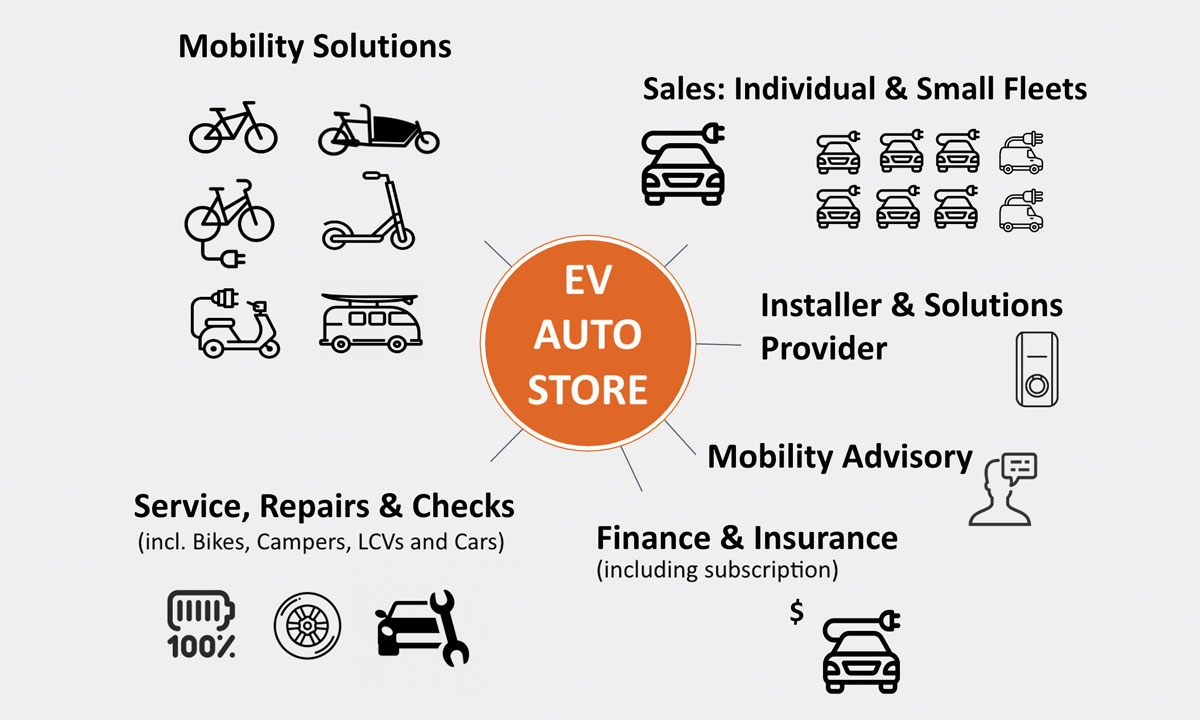

Some examples worthy of consideration include:

Charging Installation

EV customers, most of whom are new to electric cars, need advice regarding the charging solution that works best for them. A significant number of them need a home or work-based charger. This growing cohort provides notable revenue opportunities, not only with offering customers an installation service, but the charging box too.

This thinking is consistent with Clarify’s TEFF retail success model: Transparent, Efficient, Flexible and Facilitated—in particular they have the opportunity of providing customers with a more facilitated (“easy”) transition from ICE to EV ownership.

Letting your new EV customers fend for themselves when it comes to home charger selection and installation, is not only a huge missed opportunity to enhance the customer experience—and their advocacy of your dealership to family and friends—but also a missed revenue opportunity.

Why would dealers allow Amazon and the local electrician to earn these EV transition dollars? With average Level 2 wallbox chargers selling for $1,000 and charger installation costs ranging from $1,500 to $3,500 (depending on the customer’s electrical panel) including both materials and labour, the gross profit potential is meaningful.

One of the co-authors recently spent over $3,450 (before tax) on his EV transition and would have been more than willing to include the equivalent amount on the dealership’s bill of sale had it been offered as a facilitated service.

Do dealerships have experience in the sale of specialized automotive parts and accessories, installed by highly skilled technicians (rhetorically asked)? The main difference is that we’re now talking about installation at the customer’s home or office, not on the vehicle itself.

Can these logistics and liability risks be managed with the skills we already have? Yes.

And for those dealers who don’t want to establish an in-house EV charger installation team (or not yet), there are good options available like RocketEV.ca, a third-party service that dealers can offer directly to their customers, generating a commission revenue stream in the process—and with a better, TEFF-aligned customer experience.

When you consider that less than two per cent of Canada’s nearly 23 million light vehicles are ZEVs today, demand for charging solutions will be robust over the next three decade ICE to EV transition.

As Frank Schlehuber from CLEPA comments “The ability [of traditional automotive service providers] to collaborate and be open for new business models will be key success factors”.

New Finance Models

Subscription models are growing, especially in Europe including OEM-sponsored programs from Volvo and Porsche (both in Canada too), Jaguar Land Rover, Hyundai, Mercedes-Benz, and new challenger brands like NIO from China.

Subscription services are offering customers the flexibility of short term subscription terms, often including insurance and the ability to swap models.

Importantly, this arrangement offers dealers the ability to market used vehicles on a subscription basis, and thus secure service work for the duration of the vehicle’s subscription lifecycle.

The move towards offering a vehicle-as-a-service (VaaS) provides a guaranteed revenue stream for retailers.

However, this option is not merely open to the OEM, with providers like Australian based LoopIt providing a “subscription in a box” solution as a white label.

Importantly, this arrangement offers dealers the ability to market used vehicles on a subscription basis, and thus secure service work for the duration of the vehicle’s subscription lifecycle.

E-bikes and New Mobility

The sales growth of e-bikes, e-scooters and premium bicycles has been phenomenal, with the global e-bike market alone anticipated by Vision Research Report to grow from USD $41 billion in 2020 to USD $120 billion in 2030.

So why can’t new car dealers—especially those in urban markets—participate in this growth by providing customers with sales and service options for a wide range of mobility solutions beyond the core passenger vehicle business?

As Christoph Seyerlein from the German business magazine, Manager Magazin at the Mobile.de Mo:re Conference recently commented “I know a dealer who recently told me, ’I have the same margin on a good e-bike as I do from a Volkswagen Polo’.”

Underlining not only the sales potential for e-bikes, but also considering that a number of bikes share similar parts to EVs, could open the service bays to extra business.

Certainly, OEMs are entering the market with their own e-bike offerings, including Audi, BMW and Mercedes-Benz. Cynics may see these products as merely PR exercises, but for some dealers this is a growing source of revenue.

Mobility Advisory

The traditional role of the automotive retailer and service centre was to focus on the product. Electric vehicles, however, come with a new ecosystem for customers to manage. Most notably how to best look after their vehicle’s battery life, how to manage charging and determine the total cost of ownership.

As dealers are the mobility experts in their local markets, they have the opportunity to advise not only single vehicle purchasers on their transition to an EV, but also expand to advise on how small businesses, say local tradespeople, logistic companies or organisations wanting to change their fleets to electric can move effectively.

Providing advisory services not only allows dealers to gain additional revenue from sales and installation but opens up a wider customer base than perhaps was previously untapped.

In essence, retailers and workshops can expand the services they provide their community by embracing new mobility solutions and electric vehicles, in order to grow their businesses toward the new greener future. New streams of revenue are out there for those who are willing to adapt.