Some say we’ve seen this all before. But this time, it really is different.

I first wrote about this topic in 1995–1996. Then again in 2003 when Block Exemption regulations in Europe were introduced, then yet again in 2008-2009 during the Great Recession.

Some say our world is changing at an alarming rate, others say not so fast.

It seems that everyone inside and outside our industry is predicting massive shifts in automotive retail. Driven largely by an empowered consumer and an over-fueled and potentially expanded vehicle manufacturing sector, pundits believe were are on the cusp of massive infrastructure alteration.

Is the automotive galaxy looking to realign itself?

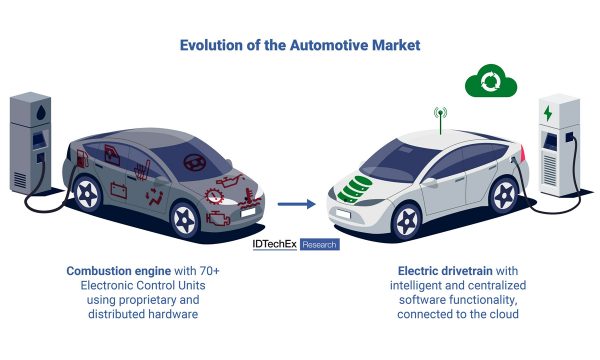

It seems that automotive manufacturers are evolving into becoming technology companies and that technology companies are evolving to become automotive companies. The reality is that we are facing industry convergence, the magnitude of which we have never seen before.

Over a decade ago, governments in North America began to single out the vehicles we were selling as main contributors to global warming. As a reaction, environmental regulations were kicked into high gear causing automotive brands to develop and design alternate fuel vehicles that are believed to be much less harmful to the environment.

Over roughly the same period, consumers embraced individual empowerment driven by companies like Apple and Amazon. Apple and others provided the hardware, software and ingenuity to attract consumers in overwhelming numbers. Amazon, on the other hand, provided the access to an online world that added every day practical application to the newly developed consumer centric hardware.

Also over roughly the same period, success of new technologies driven by companies like Tesla provided a new vision towards vehicle manufacturing and vehicle sales methodology.

In recent years, seeing automotive as the massive market it is, many newcomers and not so newcomers started adapting their business model to the new realities of the day. This added pressure to an already complicated auto retail environment but more importantly into the mindset of consumers at large.

Non-automotive retailers began to experience the pressures of online competition. Today that competition has grown to critical proportion. Long-time bricks and mortar retail brand standards like Target, Sears are shedding stores. Headlines like “Fashion House BCBG Closing Stores, restructuring” and “Pittsburgh Mall sells for $100” are almost daily occurrences.

Reports show that Black Friday Sales across the U.S. were reported at record levels with the largest share (35 per cent) going to online retailer Amazon.

Even Wal-Mart is now launching an online auto retail platform. Wal-Mart has attracted dealer group partners such as AutoNation and the AutoSaver online auto platform. Wal-Mart already has a sizeable auto repair and parts supply business.

Car companies are experimenting with the access concept. Some have invested heavily into ride sharing and other new initiatives presenting possible options to the traditional vehicle ownership and vehicle usage model.

This is nothing new. Asbury tried this about 10 years ago. Unlike 10 years ago, however, consumer capability has expanded where today online is much more mature and mainstream for many consumers.

Newly-minted U.S. President Donald Trump, just took office after he campaigned aggressively on a number of status quo breaking positions. Automotive manufacturing, climate change and NAFTA are three of the areas he singled out. The outcome of the possible shift in government regulation and direction could have a significant impact on our industry.

To say as automobile retailers that our lives are not going to be affected is sticking our heads in the sand. The question becomes, in the current sea of potential disruption, what is fact and what is fiction?

Cities like Toronto, Vancouver and Montreal are becoming congested with vehicle traffic. Virtually every major city across North America is grappling with traffic congestion. Traffic lanes are being reduced in downtown cores to provide a safer environment for pedestrians and cyclists. Traffic is being rerouted and on some core roads private vehicles are banned altogether. At the same time population in our major cities continues to grow at a very fast rate, placing additional urban pressure on our cities and suburbs.

Companies like ZipCar and AutoShare are providing consumers with access to individual transportation without the need for ownership.

Other companies like Uber are providing consumers alternative ride-sharing with a lower cost and better service than traditional taxis and public transit. All of these services are Smartphone based, playing to the insatiable desire by consumers for a life made easier through efficient use of technology that respects their time.

Car companies are experimenting with the access concept. Some have invested heavily into ride sharing and other new initiatives presenting possible options to the traditional vehicle ownership and vehicle usage model.

Two brands launched online have dominated new vehicle sales initiatives. Genesis and LYNK&CO offer consumers a direct pipeline to new vehicles without the need to visit a dealer should they choose not to. Genesis is a Canadian initiative and at the moment LYNK&CO is being launched across Europe by parent company Geely, the company that owns the Volvo brand.

Consumers have been researching their new and used vehicle purchase options online for over a decade.

Today’s consumer is very proficient and has acquired vehicle savvy online before they walk into our showrooms. In many ways, some consumers only enter our showrooms to acquire the vehicle they have already decided to purchase or lease.

This calls into question two key elements. Firstly, what is the role of the dealership in new vehicle sales and secondly, what facilities does the industry need to satisfy consumer demand for vehicle procurement?

As dealers, we must be prepared to deal with customers across all channels. This is called omnichannel, offering a seamless approach to providing customers consistent brand experiences whether it be on their desktop, laptop, tablet, smartphone, telephone, in vehicle connectivity or in person at your store.

Take your cues from your customers in order to keep them your customers. Don’t give them any reason whatsoever to look for another alternative.

You need to provide the same experience regardless of medium, completely focused on how the customer wants to do business with you. In its purest sense this requires a complete consistency between your brand and your store from a technology standpoint and human interaction standpoint. Inventory transparency is key, and all of this is not an easy thing to accomplish.

Amazon is quickly becoming the dominant retail player because of its omnichannel capabilities. We have all used Amazon to purchase products. You search, you find, you research, you receive alternative recommendations, you are shown the inventory status, you order, you decide how you want to receive your order and the product shows up the next day at your door. If it is not what you want, you repackage and send it back for a full refund, no questions asked.

Amazon has become so proficient, that consumers use brick and mortar stores to inspect the product they want to purchase then go home and order it on Amazon. Some order even while they are still in the store!

Amazon is changing consumer expectations of the retail experience. Just like Big Box retailing eliminated many small retailers and decimated small town downtown core shopping, Amazon is

doing the same thing to Big Box retailers.

Amazon recently launched Amazon vehicles. If you have not yet been to this site, you should go there and view what they are doing.

We do live in interesting and challenging times. Not all initiatives you read about in the news will be successful.

Make no mistake, however, the consumer holds the power and dictates how they want to do business.

Keeping up with consumer trends is vitally important to long-term survival.

Take your cues from your customers in order to keep them your customers. Don’t give them any reason whatsoever to look for another alternative.

There will be differences like never before between urban, suburban and rural auto retailing capabilities and consumer demand. With 26,000,000 light vehicles on the road in Canada, and new vehicle sales continuing its record pace, after sales service will be a stronghold for auto retailers for years to come and should provide longer term stability.

Of course the ultimate end game is unknown; that’s obvious.

But we are in the midst of an evolution in auto retailing driven by the technology revolution that is changing consumer behavior right before our eyes.

Our role as auto retailers is to observe and listen to our customers like never before. We also must provide the thought leadership to our individual teams by seeking out trends as they happen, fully understanding the brands we represent and the direction and initiatives they propose and investigating the impact those trends could have on our business in our local market.

No one ever said this was going to be easy!