Global events in 2012 will continue to have a big impact on the health of Canada’s automotive sector

Global events in 2012 will continue to have a big impact on the health of Canada’s automotive sector

As we enter 2012 there is likely as much going on outside of the automotive industry as inside of it, which will ultimately determine where we land as far as vehicle sales and production are concerned at the end of December.

While 2011 could have been a better year from a sales perspective, it also could have been a lot worse in view of both the known challenges the industry faced at the beginning of last year, the most significant of which was a slowing global economy, and the challenges which could have never been anticipated, such as the twin natural disasters in Japan in March followed by the severe flooding in Thailand in October.

Both natural disasters had a major impact on the entire automotive industry globally but were felt most acutely by the Japanese automakers. Both disasters highlighted the interconnectedness of the global automotive industry and the fragility of global supply chains.

The New Year brings with it the global instability baggage from 2011 associated with the sovereign debt crisis in Europe. The situation in Europe is changing on a weekly basis and it is probably safe to say, even at this juncture, that the deleveraging process and associated austerity programs that many EU nations will have to put in place to appease the market, will result in mild recession — or worse — in Europe in 2012.

As we have observed in 2011, economic instability — regardless of where it occurs — has ripple effects elsewhere and it can be expected that Canadians will continue to report low levels of consumer confidence consistent with October’s 71.8 level which, according to the Conference Board of Canada is the lowest level of consumer confidence since May 2009 at the height of the recession.

Car sales expected to rise slightly

A lower level of consumer confidence is always a challenge for higher priced, discretionary consumer products such as automobiles. That said, many forecasters are expecting Canadian light duty vehicle sales to increase by about 1% for 2012 to just over 1.6 million units.

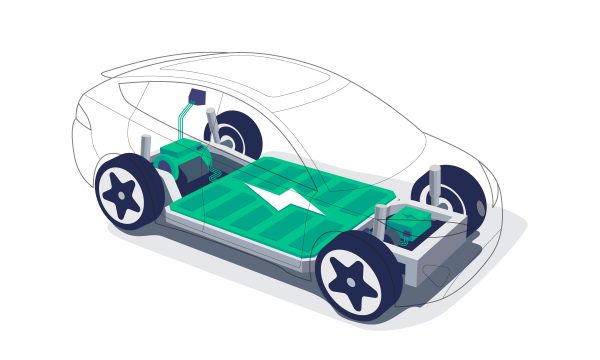

The new year will also mark the first full year of sales of a number of different battery electric vehicles, plug-in hybrid vehicles and range extended battery electric vehicles being introduced by a number of automakers as part of the effort to reduce greenhouse gas emissions by 20% by 2016 under Canada’s greenhouse gas regulations for light duty vehicles that were passed in October 2010.

Under the regulations, emission standards become increasingly more stringent between 2012 and 2016 requiring manufacturers to build advanced technologies into vehicles to meet the new standards.

New regulatory requirements for the 2017-2025 timeframe will continue to push the technological envelope. Technology does come at a price though, and as a result new vehicles will be more expensive at a time when new vehicle purchasers may be in economic circumstances where they are least able to absorb price increases.

In addition to the implications of regulatory requirements and global economic uncertainty, the Canadian government has embarked an aggressive bi-lateral trade agenda to assist in building economic prosperity for Canada while reducing its trade dependency on the United States.

The Harper government has committed to having a comprehensive economic and trade agreement completed with the European Union by the end of this year if at all possible, although the current economic challenges being faced by the EU may mean that any free trade agreement with Canada is decidedly lower on the list of priorities.

In addition to the EU, Canada has indicated that it would also like to have an economic partnership agreement with India finalized by the end of 2013 and in addition it would like to move forward with an economic partnership agreement with Japan as well. It cannot be forgotten that Canada has been working on a free trade agreement with South Korea since 2005 but which has been under a bit of a moratorium since 2008.

Bi-lateral trade deals

While the government can be applauded for aggressively pursuing bi-lateral trade deals in the face of the Doha round of multi-lateral trade negotiations under the WTO that has been stuck in neutral for a few years, the challenge for many sectors — including the automotive sector — with bi-lateral deals is the market distorting impacts such deals end up having here in Canada.

Consider that if Canada consummates a bi-lateral free trade deal with an auto producing nation, the vehicles from that nation would presumably enjoy tariff free access to the Canadian market, which would place vehicles produced in that country at a competitive advantage vis-à-vis other vehicles sold in Canada. As a result, much of the automotive industry in Canada have traditionally resisted such agreements making finalizing these deals a somewhat challenging process for the government.

One factor that could make a bi-lateral trade deal easier to swallow for adversely impacted automakers would be the reduction of Canada’s external tariff. Canada’s tariff on imported light duty vehicles is currently 6.1%. If that tariff were reduced down to 2.5% (the same level as the U.S. tariff) for all vehicles, then the advantage afforded to any automaker arising from a bi-lateral trade agreement would be significantly smaller.

Such a move by the government would also have the added advantage of providing a cost savings of several hundred dollars to Canadian consumers by lowering a tariff that no longer serves any purpose.

One has to question the wisdom of one level of government offering rebates of up to $8,500 to assist consumers in offsetting the premium cost of advanced technology vehicles that are better for the environment, while another level of government keeps a tariff in place that makes these vehicles roughly $1,500 more expensive in Canada than the same vehicle would be in the United States where it attracts a lower tariff.

Finally an opportunity and a challenge for 2012 exists with our largest trading partner under the ambit of the Shared Vision for Perimeter Security and Economic Competitiveness. As I write this article, the action plans for both the Beyond the Borders Working Group and the Regulatory Cooperation Council have not been released, even though it is understood that both are ready to go.

While these initiatives are being shepherded ultimately be the offices of the Prime Minister and the President, it would appear that other issues are getting in the way of a high level announcement by both governments. This is unfortunate because a lot of work has been done to highlight areas where changes can be made to facilitate trade across borders and to streamline and eliminate duplicate regulations between the two nations.