Major policies impacting auto sector hang in the balance

The public policy environment impacting the automotive industry in Canada has become much more complex, not less complex, over the course of the last year.

Many could be forgiven for thinking that the signing of the new NAFTA agreement — the USMCA or the CUSMA, depending on what country you are in, resolved the key issue impacting the automotive industry after a year and a few months of negotiation.

However, there is a big difference between getting the agreement signed and getting it ratified.

The USMCA was being signed just before a regime change in Mexico and just after mid-term elections in the United States that saw the balance of power shift to the Democrats in the House of Representatives.

The Democrats which have consistently been the more internally focused party and more cautious with respect to free trade agreements promised to give the ratification of USMCA a rough ride.

Meanwhile, Canada is facing a general election this fall and it is unclear at what point this year the USMCA will be ratified especially given recent statements.

In perhaps what has been the strongest statement yet against the steel and aluminum tariffs imposed by the United States on its NAFTA trading partners, amongst others, Transport Minister Marc Garneau hinted that Canadian ratification of the USMCA might not happen unless the steel and aluminum tariffs were removed in short order at recent meeting of the National Governors Association in Washington.

The closer we get to a federal election in Canada the more we can anticipate that NAFTA 2.0 will become a bit of a political football.

In the end, however, neither Canada nor Mexico are likely to ratify the new NAFTA before the U.S. does, so the country that ended up forcing the negotiation of the agreement is now holding up the works.

The same can be said for North American greenhouse gas (GHG) regulations.

You will recall that the Trump Administration revised the final determination about the appropriateness of the 2022-2025 standards almost a year ago, putting in process a new rule-making that would freeze the GHG standards at 2020 levels through 2025.

This action has thrown a curve ball into the environmental policy making of both Canada and California.

Under the Obama administration, for a few short years we had greenhouse gas emissions harmony between the U.S. National Highway Traffic and Safety Administration (NHTSA), the Environmental Protection Agency (EPA), the California Air Resources Board (CARB) and Environment and Climate Change Canada (ECCC) on common GHG emissions regulations continent-wide.

The action being taken under the development of the rule-making process that should be finalized in the United States in April or May of this year, but until then Canada has little choice but to hurry up and wait, given that our GHG regulations are not only patterned off of those in the United States but actually incorporate by reference the U.S. Code of Federal Regulations.

What does that mean? Well it effectively means that unless Canada decides it wants to proactively develop different GHG regulations for light duty vehicles that we will, by default, be following whatever the U.S. does.

This is one of the reasons why the federal government is waiting and weighing its options with respect to GHG emissions regulations.

Canada could choose to follow the U.S. It could presumably find a way to regulate adhesion to the original 2022-2025 targets, or it may choose to do something different such as adopting California standards.

Two of those three options have potential product curtailment challenges which will not only impact manufacturers but the dealers if Canada has a different and presumably more stringent GHG standard than that of the United States.

This issue is one that won’t be solved quickly either as California and the Section 177 states (those that follow California rules) have already begun legal proceedings against the U.S. federal government for walking back the GHG emissions regulations.

Those legal cases will not likely be resolved for a couple of years or more, so expect more uncertainty in this area. Hurry up and wait.

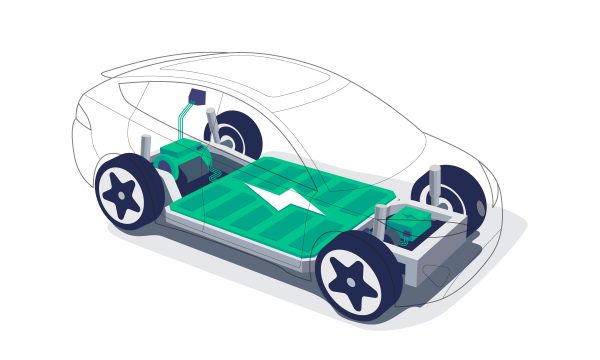

Somewhat related to the GHG regulatory environment is the issue of a National Zero Emission Vehicle Strategy for Canada.

This initiative was part of the Pan Canadian Framework for Clean Growth and Climate Change that was released in 2016 by the current federal government.

Under the Pan Canadian Framework, a National Zero Emission Vehicle Strategy was targeted for the end of 2018.

Industry representatives, ENGOs and academics were all brought to Ottawa to sit as an Expert Steering Committee on zero emission vehicles in the Summer of 2017 for an intense series of meetings over a few weeks to develop the pillars of a national strategy, and then… you guessed it, hurry up and wait.

There has been precious little public information on the National Zero Emission Vehicle Strategy since the intensive meetings in the Summer of 2017.

In the intervening period, Quebec formally launched their ZEV mandate, Ontario went big-time into incentives (up to $14,000) for EVs and then pulled the plug on all incentives with the election of the Progressive Conservative Ford government there. Last November, British Columbia also announced its intention to launch a ZEV mandate in 2020.

All that to say that there has been much water under the bridge since the expert ZEV panel convened in the summer of 2017, so much so that when the Federal Transport Minister and his provincial colleagues got together on January 21st of this year to talk about the National Zero Emission Vehicle Strategy — amongst other things — there was precious little announced on the subject in the press release after the meeting.

Apparently, there were significant disagreements amongst the provinces regarding the measures and tools that should be used with respect to such a strategy, or even the appropriateness of it for some provinces.

Regardless, that did not stop Federal Transport Minister, Marc Garneau from outlining targets of 10 per cent ZEV sales by 2025, 30 per cent ZEV sales by 2030 and 100 per cent ZEV sales by 2040 in a media scrum after the meeting of the Transport Ministers.

Whether those are hard targets or merely aspirational is anyone’s guess at this point because to my knowledge there was no discussion with anyone in the industry about such targets beforehand.

The upcoming Federal Budget may provide some direction with respect to elements of the National ZEV Strategy but the other reality is that the upcoming federal election in October is likely to keep everyone on their toes with respect to whether anything will be announced this Spring — even if it is not fully baked — to be marketed as “commitment fulfilled” going into the election or whether any strategy risks being too divisive an issue at least until after the election.

Time will tell, but until then we will have to hurry up and wait.