New-vehicle sales in Canada improved in both March and the full first quarter of 2023, relative to the same periods a year ago. But those improvements were marginal and they continue to disappoint, failing to signal any imminent upturn in the stagnant market.

March sales of about 146,000 vehicles by reporting automakers were up just 3.7% from last year, as estimated by DesRosiers Automotive Consultants (DAC). They were also down from the modest gains of the prior two months, which were 7.5% and 5.7%, respectively.

The SAAR (Seasonally Adjusted Annualized Sales Rate) for March was just 1.59 million, according to DAC — a steady drop from January’s 1.79-million figure, which was the high-point for the past year.

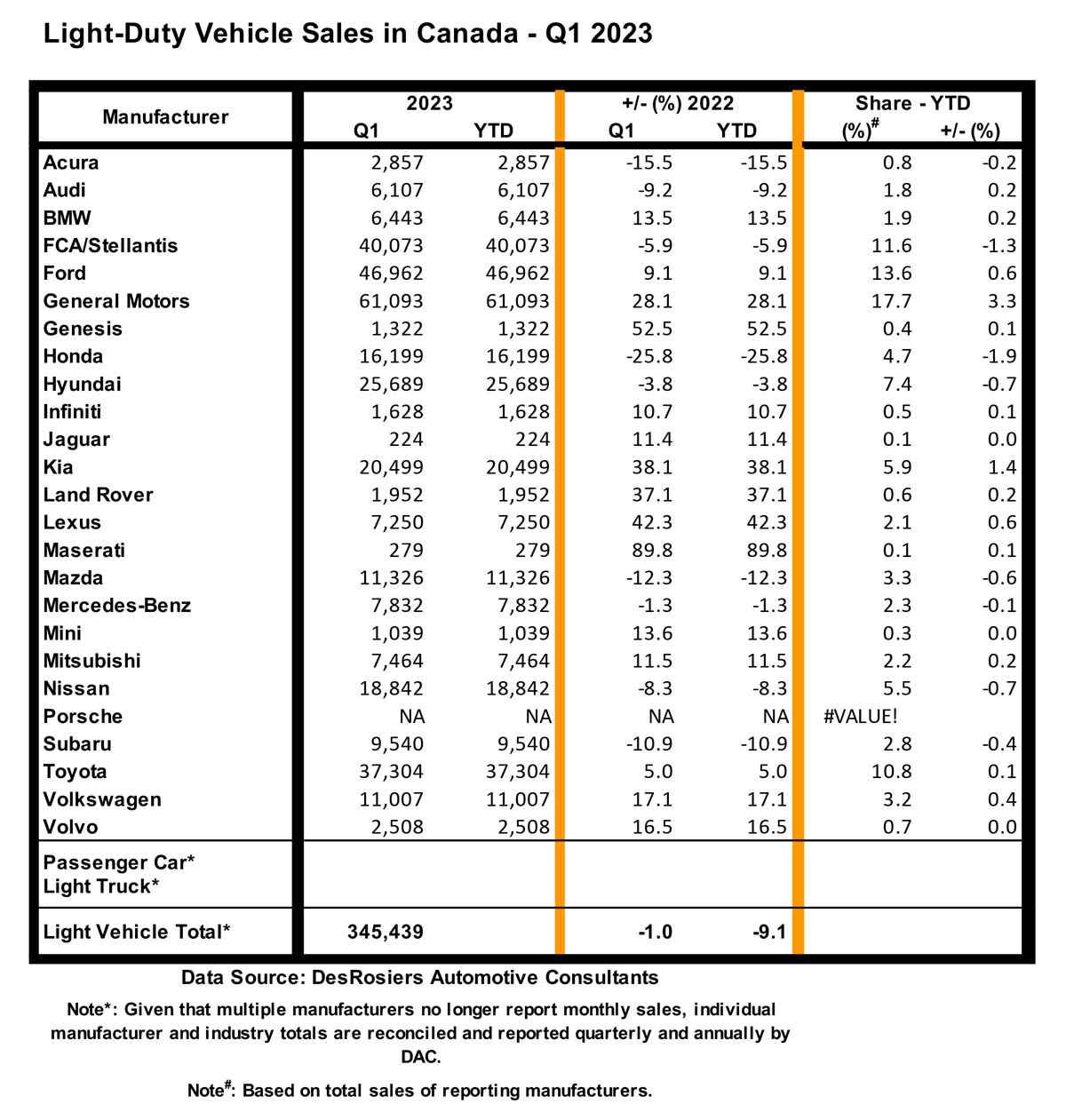

On a quarterly basis, reported sales of 345,439 new units in Q1 2023 were up just 5.2% from last year’s dismal figures, but down 8.8% from the same period in 2021 — and fully 16.0% below 2019’s pre-pandemic level.

As Andrew King, Managing Partner at DAC observed, “there is a decided lack of momentum.”

GM to the fore

Despite those concerning overall figures, some automakers had a highly positive quarter.

General Motors claimed the top-seller spot for Q1, with sales of 61,093 vehicles, an increase of 25.8% from the same period a year ago. That improvement gave GM a 3.3% bump in market share, year-over year, up to 17.7% — the greatest improvement in both numbers and share in the industry.

Ford came second for the quarter with 46,962 vehicles sold, well behind GM, but 9.1% up from a year ago and ahead of the market average. As a result, Ford’s market share improved by 0.6% to 13.6%.

FCA Stellantis ranked third for Q1 with 40,073 vehicles sold. That total was down by 5.9% from last year however, cutting market share by 1.3% to 11.6%.

Fourth place went to Toyota, which sold 37,304 new units, an increase of 5.0%, improving market share by 0.1% to 10.8%. On a group basis, Toyota/Lexus also ranked fourth, behind GM, Ford, and Hyundai/Kia/Genesis combined, but ahead of FCA/Stellantis.

Korean brands show strength

The Hyundai brand alone claimed fifth place with 25,689 sales, a decline of 3.8% from 2022 that trimmed market share by 0.7% to 7.4%.

Kia leap-frogged both Nissan and Honda to claim sixth place in the rankings with 20,499 Q1 sales, a 38.1% gain that improved Kia’s market share by 1.4% to 5.9% — a share increase second only to GM.

Though passed by Kia, Nissan maintained its familiar seventh-place ranking, with 18,842 sold, down 8.3%. That decline cost Nissan 0.7% of market share, reducing it to 5.5%.

Keeping Nissan in seventh, Honda fell two places in the rankings, down to eighth, with a dramatic 25.8% Q1 sales decline to just 16,199 units. That shortfall cut Honda’s market share by 1.9% to 4.7% — the greatest share decline in the industry.

In a tight race for ninth place, Mazda edged out Volkswagen to claim the spot with 11,326 vehicles sold. That total was down 12.3% from last year, however, resulting in a 0.6% share decline to 3.3%.

Volkswagen was right behind in tenth with a 17.1% sales increase to 11,007 units, raising VW’s market share 0.4% to 3.2%.

Subaru and Mercedes-Benz maintained their usual 11th and 12th rankings, with sales down 1.3% and 10.9% respectively.

It is also worth noting that Lexus surpassed both BMW and Audi for second position in the luxury vehicle ranks with an impressive 42.3% Q1 sales increase.

In addition, Mitsubishi jumped past all three with an 11.5% sales gain to claim 13th overall in the rankings.

It’s a volatile market!