Being aggressive and creative, and using technology, is necessary to find used car supply these days

Vehicle remarketing has become increasingly difficult for Canadian dealers because of recent unprecedented factors in the marketplace, which have necessitated becoming both aggressive and creative to maintain the flow of buying and selling used cars.

The normal method of dealerships buying cars, whether or not the consumer is bringing one as a trade-in, has changed dramatically. With new cars in short supply and selling for the manufacturer’s suggested retail price with little or no room for negotiation, some people are holding on to their existing cars longer, and some owners with expiring leases are paying to buy their vehicles rather than trade them in to purchase a new one, because it could take several months for delivery. And there are Canadian cars being bought and exported to the U.S, which is going through its own supply and demand crisis, further depleting the stock.

It’s become a used car conundrum for dealers.

“I don’t think anybody has the perfect answer, and some are probably doing better than others, there’s no doubt, but it’s an extremely challenging market,” said Michael Crosby, Dealer Principal of Crosby Automotive Group, which has four stores in southwestern Ontario. “My grandfather was really good at (buying and selling used cars) and he told me long ago that used car pricing is like the most basic supply and demand curve you could think of. Right now you have strong demand for the vehicles because of the new vehicle shortage.”

Vaughn Wyant, President and Chief Executive Officer of the Wyant Group, which has 20 locations in Western Canada, said when new vehicles are selling for a higher price it makes sense that the value of pre-owned cars will also rise.

“The gap between new and used has shrunk a lot,” said Wyant. “Vehicles are exceptionally hard to try to acquire in Canada right now.”

Robert Stein, President of Plaza Auto Group, which has six locations in and around the Greater Toronto Area, said dealers are stuck between a rock and a hard place.

“Every day you have to make decisions on how to run your business,” said Stein. “It’s obviously something we’ve never seen before. Over the last 34 years we’ve seen a lot of market changes, but never where the manufacturer couldn’t supply us with vehicles.”

Wyant said his company has about a quarter or one-third of its usual used-car inventory and the vehicles are turning over quickly.

“Our inventory is low, our selection is poor, quality is probably better and the price is higher,” said Wyant.

He said dealers are frequenting auctions more but the limited market has escalated prices.

His dealership, similar to many others, is doing far more direct purchases from customers and making that interest known, either by large signs at their dealership or through advertising.

“We’re doing everything we can to backfill the lots,” said Wyant.

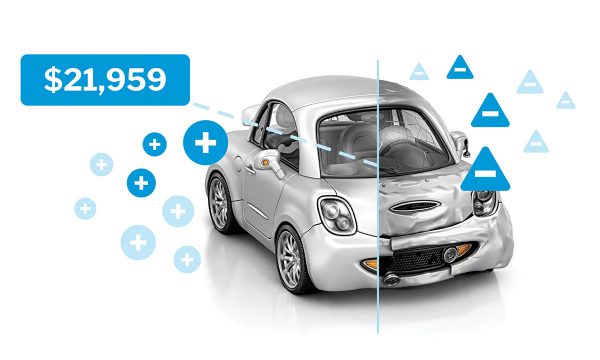

Many dealers use inventory management solution products such as vAuto to establish the real-time value of a used car. Tony Willson, President of Ontario Motor Sales, which operates three stores just outside of Toronto, said vAuto is the bible for used car pricing and inventory valuation.

“Over the past eight months or so I’ve been pushing my team to use vAuto but more so as a guide than ever before,” said Willson. “We need vehicles, supply and demand is the story here. The traditional model is gone. For dealers, it’s been quite a paradigm shift. All your metrics you used to rely on 10 months ago are out the window.”

Crosby said using technology with metrics and analytics is valuable, but he’s noticed some dealers are doing well employing the old school method of making gut decisions.

“The demand is so strong and the supply is so little, but it seems to be working,” said Crosby.

Robert McMillan, President of Volvo Cars Mississauga, said it used to be great having a used car manager that “knew all the tricks,” but these days it’s incumbent to have a younger person who understand how an app works to identify car sales.

“The old way would have been looking in the newspaper (for someone selling a car) and see if you could get them in here,” said McMillan.

At one of Willson’s stores, Clarington Kia, which opened in April 2021 and has limited new inventory and zero customer data base to tap into, General Manager Adam Hutchinson is paying someone solely to scour the market for inventory, calling people who have listed cars and making offers and doing follow-ups. Willson described it as a call centre.

“Adam blazed the trail, getting vehicles in a very non traditional manner,” said Willson.

Crosby is using various internal contests and bonuses with its salespeople to track leads from private sellers.

“Instead of paying them a commission to sell a car, you’re paying a commission to bring you a car or a client that you can buy from,” said Crosby.

McMillan said his company used to take trade-ins and wholesale them out, but now they are keeping everything.

“Everybody’s in a situation where they are trying to get any type of car, whether it’s their own brand or someone else,” said McMillan. “Unless you pay a super premium you are not going to get that car, whereas before you could get it.”

McMillan said some dealers are calling their leasing customers to make them aware their cars have value well before the contract expires.

“Normally you’d go the whole term of the lease before they were in an equity position, but these days on a four-year lease you could be in an equity position after 36 months,” said McMillen.

Stein said he’s never seen a situation where used cars have almost as much or more value compared to their original sticker price depending on the model, the year and the mileage. He is not optimistic about the overall new and used vehicle landscape changing anytime soon.

“It will continue to be that way until they figure out the chip shortage and start supplying dealers with vehicles again,” said Stein. “I don’t see that happening for another 12 to 18 months.”

He said his company routinely bought used cars even if the seller had no desire to buy a new car, but now it’s become even more impactful.

“Back then it was to get a good deal on it and now it’s just to have cars on used car lots to sell to a customer,” said Stein.

He said his company is extending existing leases for six months and calling customers when a new car similar to what they want is available.

Some manufacturers are sending letters to customers with existing leases and extending them to retain their business.

“The manufacturers’ leasing divisions are accommodating us better than they have before,” said Stein. “Obviously, they want to have retention so they make sure they don’t lose the customers to somebody who may have inventory.”

Jim Matthews, President and General Manager of LeaseBusters Inc., which has been in business for more than 30 years and has worked regularly with customers seeking to exit their leases before the contract ends, offered a stark reality of how the landscape has changed.

“Prior to last year, dealers would get trade-ins as a natural course of business or go to auctions as a natural course of business, but today dealerships are actively trying to pull vehicles from their client base, both on current leases and people who have bought cars (several years back),” said Matthews. “That would normally be something to do on a hot, dog-day afternoon when there’s nothing to do. Now they are doing that regularly in order to get more vehicles.”