Have you ever wondered what Carvana gets right? The answer is less about their giant vending machines and more about how they manage the entire customer journey—and really, the devil is in the details.

Have you ever wondered what Carvana gets right? The answer is less about their giant vending machines and more about how they manage the entire customer journey—and really, the devil is in the details.

If you check out their website, you can see what they get right on vehicle merchandising (high-resolution photos and 360-spins) and pricing (full transparency). But they also give special attention to e-commerce and the overall car-buying journey.

“Carvana exists for a reason,” said Brandon Alexander, Director of Digital Retail at DealerCorp. “And that goes back to the dealership experience, where Google did a study a few years ago that showed something like 50 per cent of customers are not happy with their in-store experience, and then they asked: would you buy online? And the answer was yes, and that’s why Carvana exists.”

In an interview with Canadian auto dealer, Alexander said many dealerships are trying to build a sales process around their digital retailing solution and had to figure it out on their own. But it is not an out-of-the-box solution: it’s an area dealerships need to spend time on to better understand how to use it.

To do that, he advises focusing on the past, present and future—the past being, who purchased a vehicle in the past? And how do you, as a dealer, equity mine your database with your digital retailing solution to present transparent numbers on things like down payment interest terms and legal requirements?

The present, he said, is about working your service drive around the appraisal structure and deal, whereas the future should focus on contract end-dates, lease returns, anniversaries, and phone calls.

“So the past, call it the comfort of your couch. The present is service drive, internet leads, transparency—everything you’ve got going on right now,” said Alexander. And the future is about turning simple messages to customers into actionable things that help keep them educated about their situation, and all through digital retailing.

“We don’t think there’s thousands of people lining up to buy cars online. We think there’s thousands of people lining up to get more information online.”

— Christian Hamaoka, Sales Director at DealerCorp

That education aspect is sometimes underestimated, according to DealerCorp Sales Director Christian Hamaoka, who believes consumers are hungry for information. “We don’t think there’s thousands of people lining up to buy cars online. We think there’s thousands of people lining up to get more information online,” said Hamaoka.

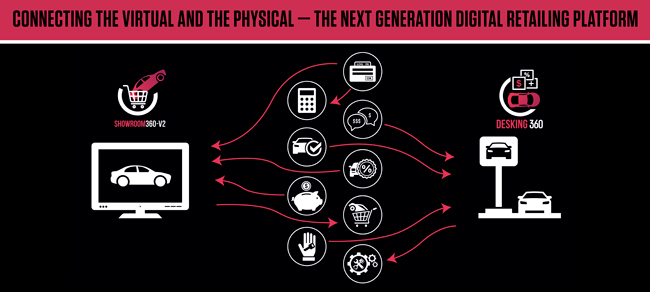

DealerCorp launched Deskit Digital Retail (DDR) in June 2020. Its digital retailing platform leverages the company’s Deskit tool and can complete the entire online purchase of a vehicle through one system, including all the paperwork. The only thing they cannot do is deliver.

The idea is to move away from what Hamaoka calls “glorified web leads” (digital retail leads) and instead take that lead further down the funnel to the sale, where other systems are involved—such as a quoting, desking, F&I, and contract-generating systems.

“Now that customer experience has changed,” said Hamaoka. “They started with a specific platform online and now they’re interacting with other components at the dealership, and that’s what’s precious to the dealers: the customer experience.”

Good digital retailing can create a ripple effect

When done correctly, digital retailing can create a ripple effect on customer interactions and engagement, and even profits.

A study conducted by Roadster and done in partnership with the National Automobile Dealers Association (NADA) and Upwave, a third party consumer survey company, examines the many opportunities that are emerging as a result of dealerships implementing digital retailing, and how these implementation levels are impacting return on investment.

The report considers the recent experiences of 304 dealerships and 1,008 consumers in the United States with digital retailing, and found that consumers are doing more online than ever before, with 86 per cent doing a portion of the transaction online—up more than 42 basis points since September 2020.

It also found that most consumers have some kind of remote interaction during the process; lower funnel buying activity was evident and continues to grow, with big gains seen in credit apps (44 per cent), F&I (33 per cent), and contracting (27 per cent). These are prime areas for dealership ROI increases.

And 82 per cent of consumers now learn about service and protection plans online: 94 per cent of them when buying 100 per cent online, and 42 per cent of consumers even if they have not done a single step online. Consumers are also more likely to add F&I products if they buy online.

“We looked at the two slices of the pie—those that bought 100 per cent online, which in our consumer study was 10 per cent. And those who bought only in the showroom, meaning they didn’t do any online activity, which was about 14 per cent of the audience,” said Roadster CMO Michelle Denogean. “What we found is that those that bought 100 per cent online were 50 per cent more likely to add F&I than those that didn’t.”

To break it down, 90 per cent of car buyers who bought 100 per cent online did add F&I products, versus the 61 per cent of consumers who bought F&I products in the showroom.

The study also found that 89 per cent of online consumers interact with someone at the dealership remotely, and more than 80 per cent who bought online had help configuring their deal or were guided by someone at the dealership.

It should come as no surprise then that in May 2021, Roadster released a new managed chat service known as Express Store Live that instantly connects consumers with the company’s team of auto experts to reply to in-depth car questions, and help move consumers further down the car-buying funnel.

Another interesting find from the report reveals that digital retailing can speed up transaction times; 84 per cent of consumers said their purchase was more efficient, compared to 63 per cent in September 2020. Transaction time length declined from 2.5 hours in 2019, to 1.43 hours in 2021. Importantly, online buyer satisfaction increased to 77 per cent, compared to 28 per cent for the in-store experience only.

“Most dealers have digital retailing, but they’re not all using it proactively to engage with customers,” said Denogean, adding that, when they looked at how dealerships use it against the percentage of sales that were influenced by digital retail—“when they use it with every customer, they’re pretty much influencing every sale.”

User engagement and doing your homework

Looking at Carvana’s website, it is clear the company has done its research, put an effort into its vehicle merchandising, understands that consumers want transparent pricing, and offers a seamless car-buying experience.

It also understands that the culture around car-buying has changed, and that user engagement remains a key ingredient for success. That concept is something that Louis-Yves Cloutier, CEO and President at 360 Agency, explored with Canadian auto dealer.

360 Agency is a developer of integrated e-commerce solutions and automotive software. The company offers a range of solutions, including one known as Showroom 360-V2.

“We did a study over the last few months, because we have a lot of dealers running Showroom 360-V2, or digital retailing,” said Cloutier. “So we did the study on how much time a customer spends online when they go through our build-and-buy versus the time they don’t, on the same website.”

Cloutier said the average time for consumers going into their build-and-buy is eight minutes. In comparison, the average time for consumers going through the same website but not going through the build-and-buy was two minutes. In this example, he said two-to-three minutes is the industry standard for time spent onsite.

When consumers use an engaging platform where they feel that they are creating their transaction at their own pace, without being pressured from the dealership, Cloutier said the time spent on the website increases. He said consumers want to take their time to shop and make the right decision.

“They’re more educated and dealers have to put themselves in the shoes of these kinds of consumers and really analyze what they do,” said Cloutier.

Dealerships that take the time to understand their digital retailing tool, how far it can stretch in terms of customer interaction, and study what the consumer has been doing, such as their browsing history and the quote they built online—these retailers can avoid the pitfall of solely focusing on trying to get a customer into the store to buy a car.

“If, as a dealer, you make it pleasant, you’re going to win customers over and over again, because the steps are well mapped out and you understand why the customer did what they did online, how it affects the in-store experience/ journey and vice versa,” said Cloutier.

He said there are countless ways to start a purchasing experience and dealerships need to understand all of these ways, while also facilitating them in a seamless manner.

The four components of digital retailing

While it is clear consumers want more online access to work on their car-buying journey, they also want engagement from the dealership in a way that helps them move forward when needed, and in a seamless manner that does not force them to repeat steps unnecessarily.

So the idea that a significant number of consumers want to buy online may not be correct, according to Marty Meadows, President at AutoVerify, who said there is a mismatch between what the consumer’s needs are and what the dealership is being told.

“If, as a dealer, you make it pleasant, you’re going to win customers over and over again, because the steps are well mapped out and you understand why the customer did what they did online, how it affects the in-store experience/ journey and vice versa.”

— Louis-Yves Cloutier, CEO and President, 360 Agency

“What the customer is telling us is they’re not ready to totally buy the car online yet,” said Meadows.

This is an area that Carvana understands well, because even though it appears its key focus is selling cars online, that is actually the end result. Selling cars is their goal, but they have a clear focus on the customer experience.

When consumers write about their car-buying experience, five stars are the norm for Carvana. They use words like seamless, efficient, pleasant, knowledgeable, and responsive, and they describe their customer experience as “outstanding.” One customer even wrote: “Never shopped at a dealership and now I never will.”

This is why understanding what digital retailing really means is important, because it can be a game changer for dealerships. What Carvana gets right are components of digital retailing, which Meadows breaks down into four parts: merchandising, research, e-commerce and desking—along with the added balancing act of managing cost reduction.

“Most dealers have some form or some component of that. If you have none, focus on it all,” said Meadows. “If they looked at merchandising, research, e-commerce, and desking and asked the question, ‘does my online solution solve those problems?’ And if the answer is yes, fantastic, you’re ahead of the game.”

Meadows said AutoVerify, a division of Mobials, includes all four components under one umbrella. And in May 2021, it added enhancements to its Digital Merchandising solution to help dealerships drive more profit to their F&I department through the store’s website.

The idea is to bring the “back-of-the-house to the front-of-the-house” without mentioning the price of F&I offerings. The solution works by adding Spotlights (things like new vehicle listings, low mileage vehicles, recent price reductions, available protection products, and more) to the vehicle details page.

Asked what advice Meadows can offer to dealerships across Canada, he pointed to the importance of doing your homework on what works for both the retailer and the customer. “Listen to your customers: look at the data and how your customers want to transact with you online, reduce your costs, and then ensure your business is future-proofed.”

There is a lot that Caravana gets right, but there is nothing magical about the recipe because dealers can do the same thing. And even though the company is based in the United States, there will be other Carvanas of the world popping up to meet a demand that customers believe only they can meet.

Dealers just need to make them aware of what is possible.

And it is all possible.