Government regulations and chasing credits leads to electric vehicle haves and have nots in different parts of Canada.

The “post-COVID” reality of car dealerships will be substantially altered from what it was just months ago. And one difference has nothing to do with the current pandemic.

By the time we make our way out of this crisis, Canadian dealers will likely be divided into two very distinct groups: the electric vehicle (EV) Haves and the EV Have-Nots.

In the coming months, some dealerships will likely have gained much easier access to specific new models, while others may find it difficult to be assigned EV inventory. It comes down to measures taken by some provincial governments. But to understand what the future may look like, we must first look at the past.

On January 11, 2018, the Quebec Zero-Emissions Vehicle Standard (Qc ZEV Std) came into force. In 2018, Quebec was one of eleven jurisdictions in North America to have a ZEV standard.

To be clear, a ZEV standard is a regulation that requires automakers to sell a certain number of vehicles with zero tailpipe emissions — so either electric or hydrogen-powered models. The language typically requires automakers to accumulate credits from the sale of specific vehicle types. The amount of credits required is usually linked to its sales volume within the jurisdiction: the more vehicles sold, the more credits the carmaker must earn to offset these sales.

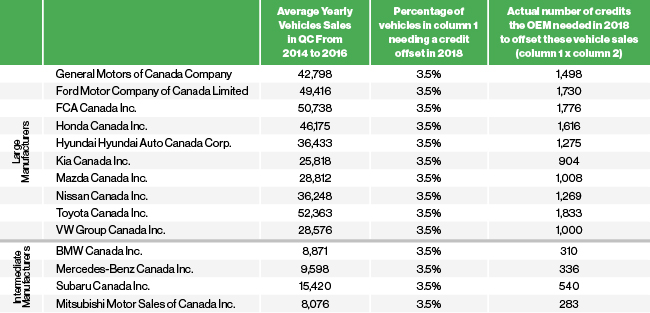

In 2018, automakers were required to accumulate enough credits to offset a percentage of the yearly average vehicles they sold within Quebec from 2014 to 2016. For 2018, that percentage was 3.5 per cent at a rate of one credit per vehicle.

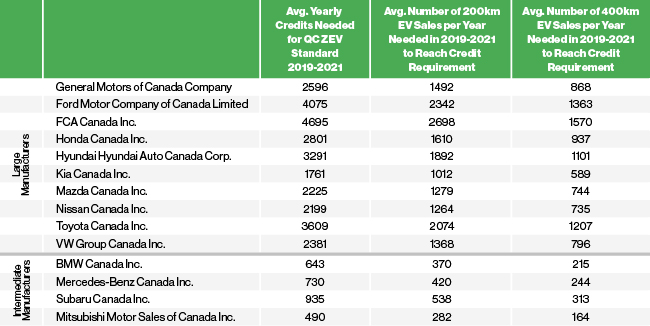

Figure A, based on values published by the Quebec government, shows the calculation for each automaker that was needed to accumulate credits in 2018.

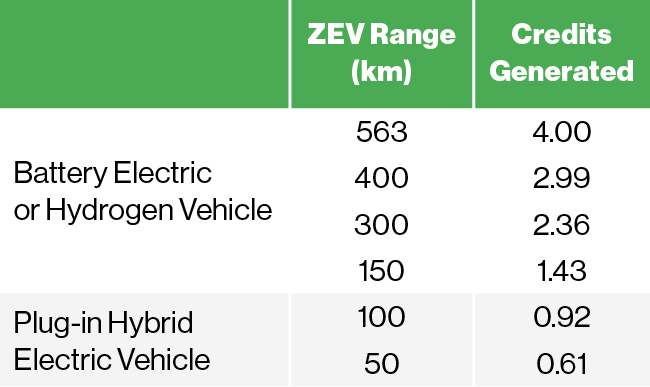

The range a given model can deliver with no tailpipe emissions determines the number of credits each sale is worth: a plug-in hybrid with 50 kilometres of electric-only range gets fewer credits than an all-electric model with 300 kilometres of range.

Under the Quebec standard, the maximum number of credits each vehicle can provide to an OEM is four. As a point of reference, Figure B shows the number of credits provided by various qualifying vehicles.

What happens if an automaker doesn’t sell enough ZEVs in a year to generate the credits it needs?

It has three options:

- Compensate with unused credits it generated and “banked” in a different year;

- Acquire credits from another OEM with unused credits; or

- Acquire credits from the government. (In the Qc ZEV Std, the cost to the automaker is $5,000 per missing credit).

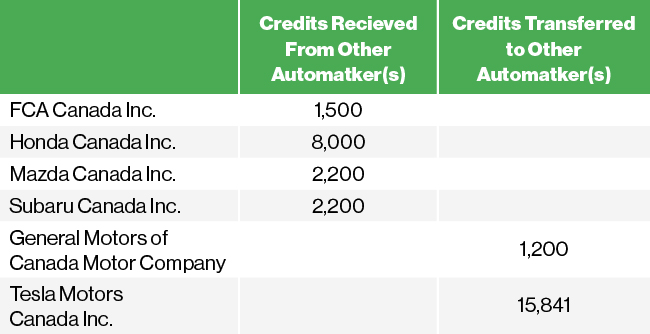

In 2018, five automakers chose to acquire credits from another maker to compensate for missing credits. The “buyers” and “sellers” for 2018 can be found in Figure C.

So far no automaker has elected to buy credits from the government at $5,000/credit.

The next official evaluation period for compliance will be 2019 through 2021. But the numbers will grow: In 2018, an automaker only needed to cover 3.5 per cent of average yearly vehicle sales with credits. This percentage increased to 6.5 per cent in 2019, 9.5 per cent in 2020 and 12 per cent in 2021.

Taking into account remaining unused credits from 2018, Figure D shows how many credits each automaker must accumulate on average each year from 2019 to 2021 — if their average yearly vehicle sales remained flat from 2014-2016 to 2016-2019. The table also shows two basic compliance scenarios as a point of reference.