What months of pandemic data reveal about EVs and what that means for dealerships.

Earlier this year, the COVID-19 pandemic brought the Canadian and the United States economies to a nearly instantaneous halt.

After months of dealing with the crisis, the automotive sector and many others have yet to fully recover and are already preparing to deal with the possibility of a second wave of sporadic lockdowns, as infections continue to surge across the continent. But if we backtrack to March, there was one exception within the auto sector that circumvented falling “in the red” — electric vehicle charging station deployment.

How does the success of EV charging station deployment impact Canadian dealerships?

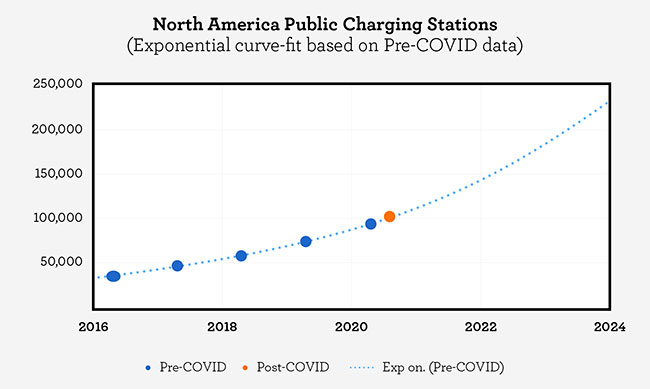

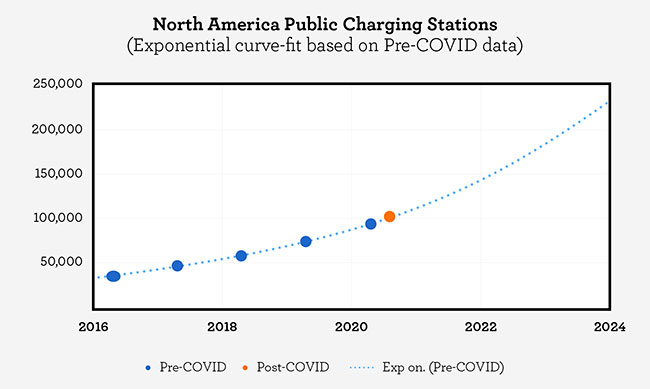

For years, investors have scrutinized the EV charging station deployment rate as a key indicator of electrification trends within the auto sector. Multiple studies have demonstrated that an increase in public charging deployment in a given region is a precursor to an increase in consumer appetite for new electric vehicles (EV) in said region.

As the pandemic has exposed, when global value chains are disrupted by such major events, it can be hard to foresee, in the moment, the full picture of the short- and long-term impact of the crisis.

Such a drastic general economic slowdown, as triggered by the pandemic and the related shutdowns, wreaks havoc on both the supply and demand for new vehicles.

For instance, last spring, production at major factories worldwide slowed down and in some cases halted altogether. Simultaneously, thousands of potential car buyers stayed home instead of heading to the dealership.

In Canada, the result was a 36 per cent* reduction in year-over-year sales of new cars halfway into 2020. This, despite an above-average start to the year in January and February. Thirty-six per cent represents the overall reduction in total sales of light vehicle types.

How does the EV sector compare?

We’ve heard a number of theories in the early days of the COVID-19 crisis about what the impact would be on new EV sales. New data published by Electric Mobility Canada indicates that the year-over-year decrease in EV sales for the first half of 2020 was 23 per cent, indicating that EV sales were less impacted than internal combustion engine (ICE) vehicle sales.

In Canada, EVs accounted for 2.7 per cent of new vehicles sold in the first half of 2019 versus 3.3 per cent of new vehicles sold in the first half of 2020. The end result is a noticeable increase in market share that further solidifies the growing importance of this segment, even through unprecedented times. Clearly, this is a positive indicator for EVs.

As surprised as some pundits were by the strong performance of EVs through the first half of the year, the most impressive indicator isn’t related to EVs themselves, but rather to the infrastructure that enables widespread EV adoption — charging station deployment.

Since the beginning of 2020, EV charging station deployment has continued to accelerate in North America without any perceivable negative impact from the pandemic. Zero, zilch, nada — no negative impact.

Not only has EV charging station deployment stayed on course with the exponential curve it has been following since 2016, but also this indicator performed slightly above the pre-pandemic projection curve!

The performance of EV sales in the first half of 2020 and the fact that EV public charging station deployment kept accelerating throughout a global pandemic sends a strong economic signal to dealers.

Those who want to increase their overall sales volume in the coming years must invest time and effort in the EV side of their business. With the all-time peak ICE vehicle sales per year behind us, increasing resources toward EV sales is not only a strategic business opportunity but a necessity for long-term growth.

It will become increasingly difficult for dealers to grow their new vehicle sales volume without relying more and more on EVs to fuel that growth. Canadian dealerships should consider this fact seriously. If the current global pandemic didn’t slow down this trend, then it is unlikely that anything will.

*Statistics Canada. Table 20-10-0001-01 New motor vehicle sales