Lax policies and a lack of internal controls are driving fraudulent behaviour. It’s time to tighten up.

Let’s talk about fraud. It’s the dreaded “F-Word” of the business language.

While this issue exists in all industries, it is particularly prevalent in the retail automotive space. It seems easier to steal from a dealership—it’s sad, but true. Internal controls are weak and seem to be on the bottom of the list of things dealer principals are interested in.

Internal controls are more important to dealerships because of their complexity. With multiple profit centers under one roof, the business changes at the speed of light and internal controls generally lag very far behind.

There is a lot of money in a dealership and a lot of portable assets that are susceptible to theft. Passwords are weak and, sadly, often shared. There are a lot of computers open for access to enter transactions as quickly as possible.

Failing “segregation of the duties” is by far the biggest problem. Many dealerships are family-owned, so separation of responsibilities often slides by. Let’s face it, internal control is not that “interesting” so there is little attention paid to it. Many would rather go to a social media site than any presentation about accounting.

According to the 2020 Global Fraud Study by the Association of Certified Fraud Examiners (ACFE), a typical fraud case lasts 14 months and costs businesses $8,300 per month. Half of all occupational fraud comes from Operations (15 per cent), Accounting (12 per cent), Executive/Upper Management (12 per cent) and Sales (11 per cent). More than 5 per cent of an organization’s revenues will be lost each year due to some form of fraud.

According to the 2020 Global Fraud Study by the Association of Certified Fraud Examiners (ACFE), a typical fraud case lasts 14 months and costs businesses $8,300 per month.

The typical fraudster is in middle management (GSM, Parts Manager, Service Manager, Controller, etc.) who has been with their organization for over five years. Males continue to lead the way in this category, accounting for over 72 per cent of the losses. If an individual has a university degree or higher and is aged 55 plus, they are more likely to commit fraud in the automotive space.

Misappropriation of assets continues to be the leading cause of fraud (24 per cent according to PwC’s 2018 Global Economic Fraud Survey). This includes theft of cash, inventory (parts/vehicles), computers, stationary, etc. That said, I fully expect this figure to be significantly higher in dealerships so it’s incumbent on us, the players in the retail automotive ecosystem, to mitigate this.

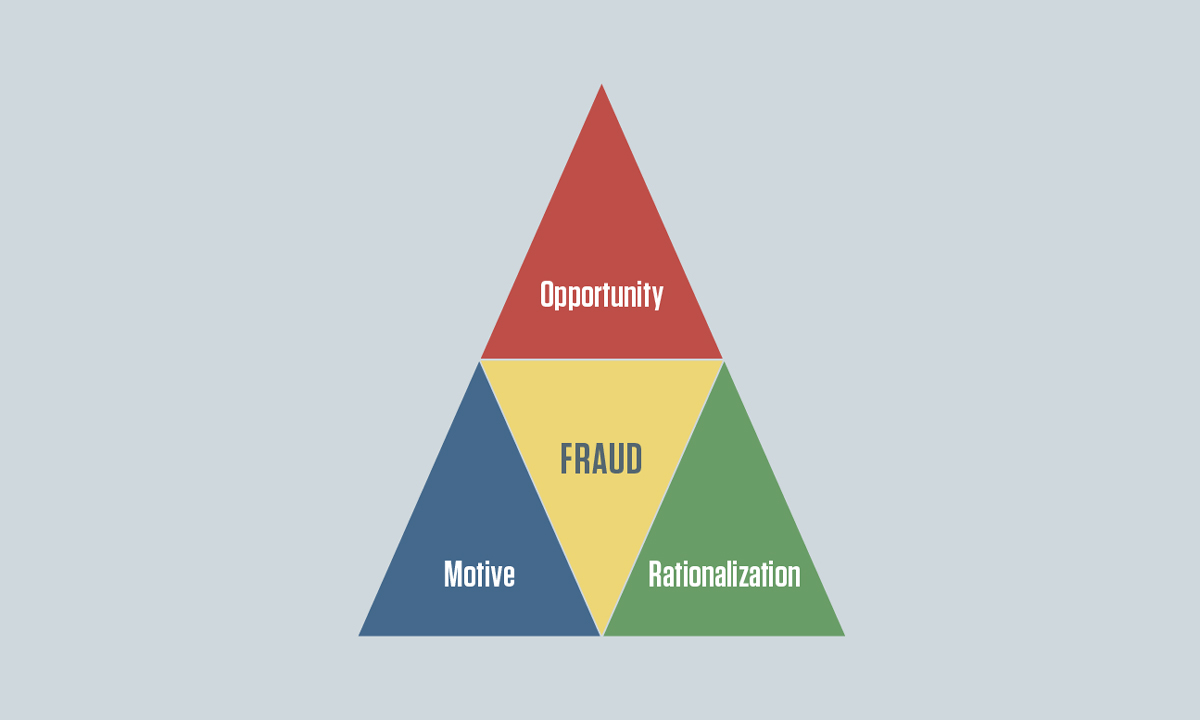

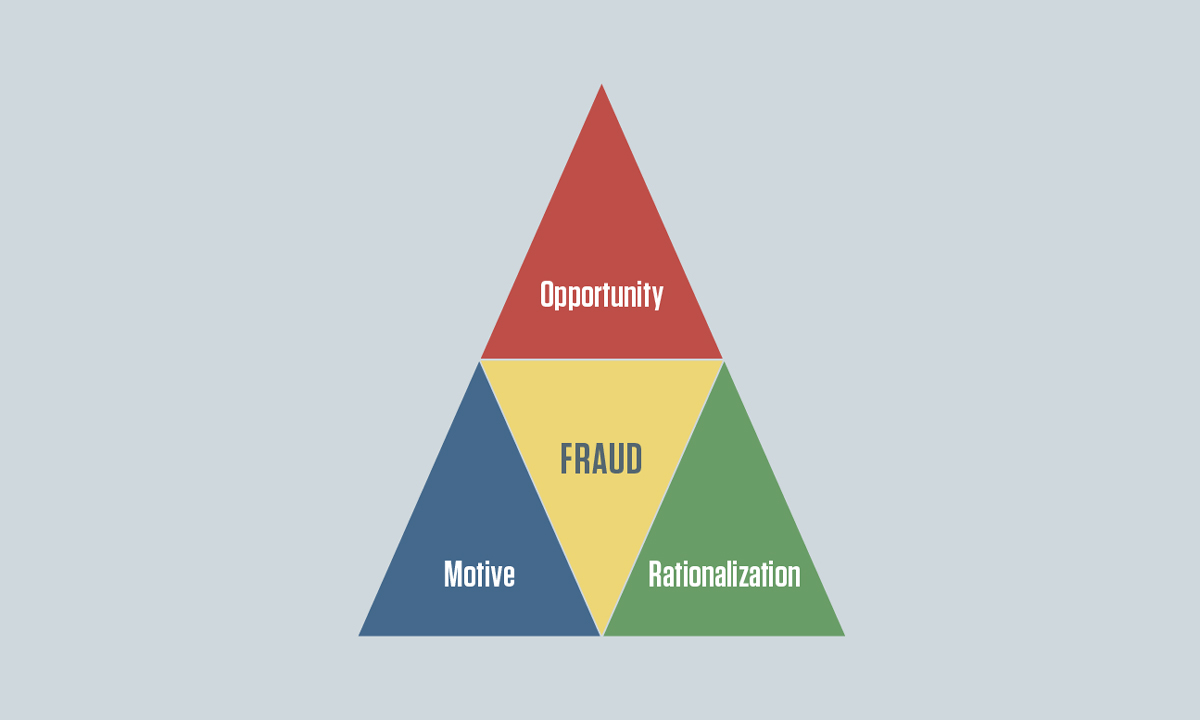

So why does fraud happen you ask? It can be explained by the simple triangle shown in figure 1.

Figure 1: Reasons fraud occurs

Opportunity:

When a business has weak internal controls, it creates opportunities for fraud to occur. If you leave cash lying around, rather than putting it into a safe, it will get stolen. If you leave the keys to your brand-new vehicle inventory sitting on a table, the car will be gone before the end of the day.

Motive:

People are motivated to commit various forms of fraud when life events happen to them that drive a need to steal. Examples of this are gambling, alcohol, drug addictions or extreme debt. When these exist in a person’s life, it will generate an inherent need to commit fraudulent acts.

Rationalization:

A fraudster may justify fraud. This justification could be related to job related dissatisfaction or perceived entitlement. “I don’t get paid enough,” or “Nobody will miss it,” are common phrases you will hear when individuals try to rationalize their acts.

How do we limit fraud cases in the dealership you may ask? Internal controls—you need to implement them, monitor them and test them to ensure they are working properly.

Hire competent and reliable people. Do background checks and force vacations to be taken. Provide employees with a clear assignment of duties.

Place importance on these controls: Separation of Duties, Limited Access to Accounting Systems, Physical controls of Assets and an Approval Authority Matrix. If these are working within your dealership, the probability of fraud will diminish substantially.

Strong internal controls will yield reliable financial records. If we can trust data inputs then we can be sure the financial outputs will be accurate. A solid control framework will always increase operational efficiency. This includes timely information for management decision making and the prevention of fraud and errors. Most importantly this will create a safeguard around your assets.

Don’t ignore this topic. Start the new year reenergizing your internal control policy. If you don’t have one, now is the time to build one. Our industry will continue to evolve and the opportunity for fraudsters will broaden. It is up to our industry leaders to make this important topic a priority.

Focus on it. Control it. Own it. You’ll be better off for it.