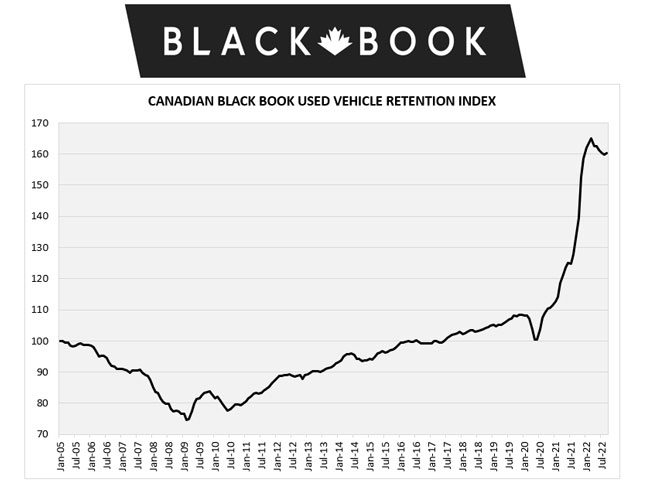

For the first time since the beginning of the summer, the Canadian Used Vehicle Retention Index has increased, after concluding a huge run up of prices that began in the late summer of 2020 and peaked in March. The most increases were seen in smaller, more fuel-efficient categories, indicating that high fuel prices are influencing consumer behaviour.

“After the crazy ride the Index took from 2020 to March of this year, it seems as if prices have somewhat stabilized. We are seeing more normal fluctuation month-to-month. That said, this stabilization is occurring at a much higher price point compared to past years,” said David Robins, Principal Automotive Analyst and Head of Canadian Vehicle Valuations at Canadian Black Book.

The index reported that “Year-over-year, all segments measured by Canadian Black Book saw growth except full-size pickups, which continued losing this month at a rate of 4.55% since last September.” As in August, sub-compact car and compact car segments saw the most growth year-over-year, with 47.58% and 43.1% respectively, “further backing up the theory that fuel prices are driving purchase behaviour.” The other two categories with the least growth are small pickups at 2.93% and full-sized crossover/SUV at 0.33%, which “adds to the argument about high gas prices driving consumers to smaller vehicles”.

The report notes that “Only 8 of the 22 vehicle segments tracked on the Index saw some value growth, with minivan leading the way with month-over-month change of +1.98%, followed by Compact Car at +1.64% and Prestige Luxury Car at +1.12%. Of the remaining 14 segments, the largest value losers were Full-Size Van at -4.67%, Sporty Cars at -1.66%, and Sub-Compact Luxury Car at -1.06%.

The Canadian Black Book Used Vehicle Retention Index is calculated using CBB’s published Wholesale Average value on two to six-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, and condition. The Index dates to January 2005, where the Canadian Black Book published a benchmark index value of 100.0 for the market.